AI, Bubbles, and Your Retirement Plan: A Long-Term View

It’s impossible to ignore the headlines lately. Artificial Intelligence (AI) seems to be everywhere, and it’s driving a lot of the stock market’s recent gains.

This has left many folks, especially those near or in retirement, asking a very fair question: Are we in another bubble, just like the dot-com crash in 1999?

It’s a concern I take very seriously, and I want to tackle it head-on. It's true that the spending on AI is staggering—easily in the trillions of dollars—as massive companies build data centers and buy mountains of new equipment.

But does all this spending mean it's a bubble?

Bubble vs. Breakthrough: Lessons from the Past

In the moment, it’s almost impossible to tell the difference between a bubble and the beginning of a genuine transformation.

Remember the dot-com bust? In hindsight, it’s obvious that companies with no revenue were valued at billions. But here’s the fascinating part: even though the bubble burst, the technology—the internet—was absolutely real.

The internet did, in fact, change our entire world. Companies that survived that crash, like Amazon (which lost over 90% of its value!), went on to become giants. The initial timing was wrong, but the idea was right.

A more recent example is cloud computing. A decade ago, many worried the spending was excessive and looked like a bubble. Today, the cloud is a fundamental part of our daily lives.

One key difference today is that many of the companies leading the AI charge (like the "Magnificent 7") are already established, highly profitable businesses.

A Look at the Bigger Picture

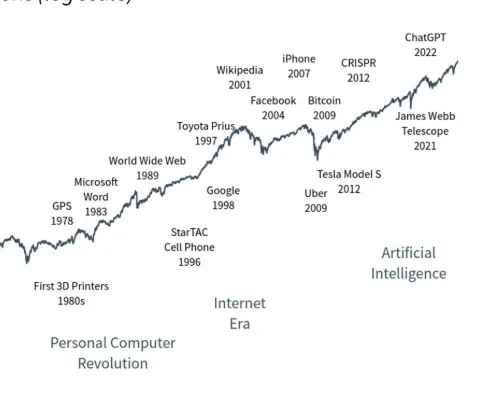

I often find it helpful to look at the bigger picture. This chart shows the stock market's growth over the last century, plotted alongside major technological innovations.

Look at all those innovations listed on the way up: Television, Jet Flight, the Space Age, the Personal Computer, the Internet... and now AI.

Each one of these likely had people wondering if it was "too much, too fast." Each one probably felt like a potential bubble at some point.

History shows that these powerful new technologies take time to pay off. The railroad boom, electrification, and the internet all followed a similar pattern:

Huge initial excitement and investment.

A "reality check" correction as people realized profits would take longer than they thought.

Ultimately, the technology fundamentally reshaped the economy for the better.

What This Means for Your Financial Plan

This brings us to the most important question: What does this mean for your retirement plan?

It’s not our job to guess whether AI is a bubble or not. Our job is to build a plan that can succeed either way.

Your retirement plan is built on a foundation of diversification. We design it to benefit from innovation over the long haul, but we also protect against "concentration risk." That’s just a term for putting all your eggs in one basket.

Even if AI is the most transformative technology ever, we know that even great companies can have terrible years or even a lost decade. That’s why your portfolio isn't just in technology. It’s balanced with other sectors, bonds, and assets designed to provide stability and income.

This balanced approach means we won't capture every last penny of upside when one sector is soaring. But it’s not designed to. It’s designed to weather the storms, manage the volatility, and keep you on track toward your retirement goals, regardless of what the headlines say.

So, back to the original question: AI represents a genuine technological revolution. But the path from today’s excitement to tomorrow's profits will likely be bumpy and take longer than many think.

Instead of trying to guess the future, we’ll stick to our long-term plan.

As always, if this is on your mind, please reach out. I'm here to talk through how these developments affect your specific situation.