Fraud at the Front Door: A New Threat to Your Retirement Security

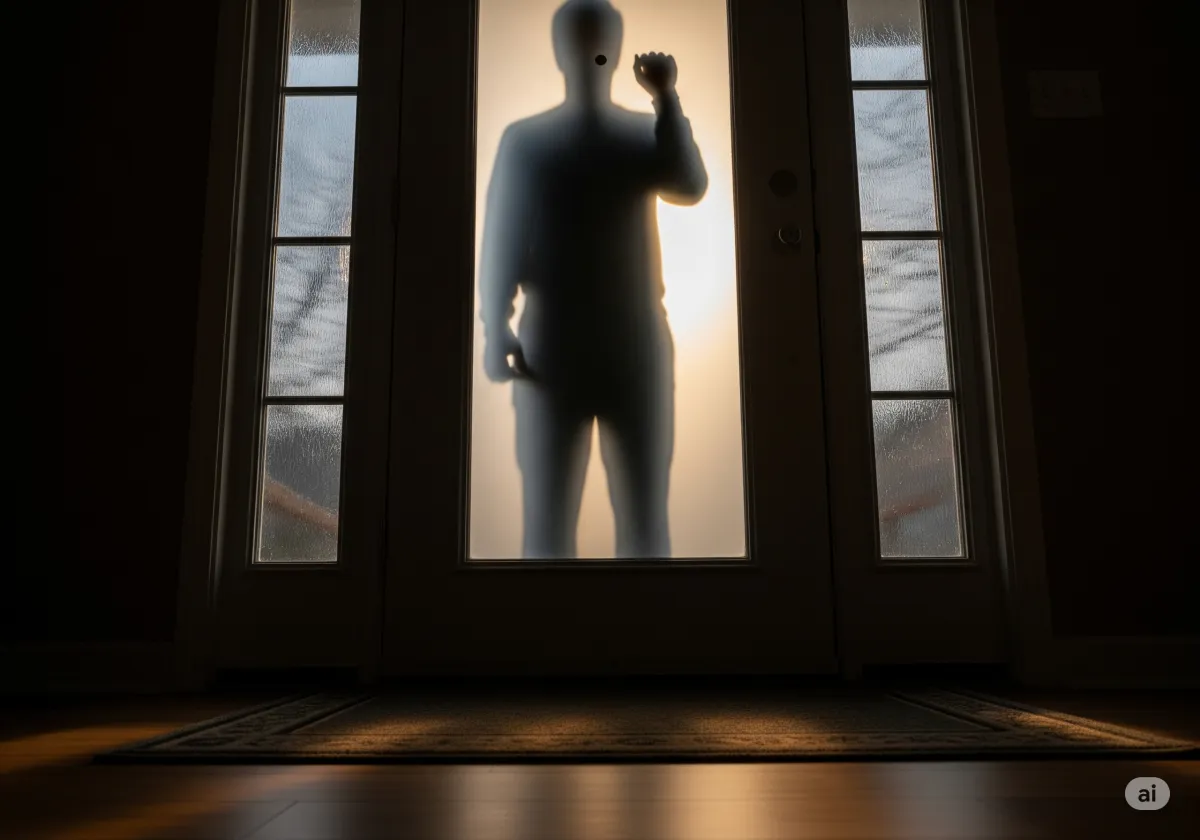

When you’re planning for retirement, we spend a lot of time and effort building what I often call your financial 'house.' It’s the structure we carefully design to provide a lifetime of income, shelter you from market storms, and give you lasting peace of mind. But building that financial house is only part of the job; we also have to protect it. Today, I want to address a deeply concerning new threat that targets not just your accounts online, but your personal safety at your own front door

Scammers are no longer content to hide behind a computer screen or a phone line. In a disturbing shift, criminals are now showing up on people’s doorsteps to collect cash, gold, or other valuables in person. This takes the threat from being purely financial to something much more immediate and potentially dangerous. It preys on our instinct to trust someone standing in front of us, especially when they claim to be from the government or your bank.

I want you to be prepared, not scared. Let’s walk through how these scams work and the simple, powerful steps you can take to shut the door on these criminals.

The Scammer’s Playbook: From a Phone Call to Your Front Porch

These scams don’t start with a knock on the door. They almost always begin with a phone call, text message, or email, following a predictable pattern.

The Hook: It starts with a message designed to get your attention and create alarm. They might claim to be from the IRS, Social Security Administration, your bank’s fraud department, or even a tech support company like Microsoft or Apple.

The Crisis: They’ll tell you there’s an urgent problem. Perhaps your bank account has been compromised, you owe back taxes and a warrant is out for your arrest, or a prize is waiting for you. Whatever the story, it’s designed to make you panic and suspend your critical thinking.

The "Solution": This is where the new danger comes in. Instead of asking for a wire transfer or gift card codes over the phone, they’ll tell you the only way to fix the problem is with an in-person transaction. They might instruct you to withdraw a large amount of cash or even buy gold bars.

The In-Person Collection: They will then send a "courier" to your home to pick up the assets or arrange to meet you somewhere. By showing up in person, they can use intimidation and high-pressure tactics that are much harder to resist than a voice on the phone.

They specifically target older adults, hoping to find someone more vulnerable to authority and intimidation. But anyone can be a target when caught off guard.

Your First Line of Defense: The Phone and Email

Since the scam starts here, this is your first and best opportunity to stop it cold. If you receive an unsolicited and alarming message, here’s what to do:

Pause before you act. Scammers create a false sense of urgency to prevent you from thinking clearly. The most powerful thing you can do is take a deep breath and refuse to be rushed.

Verify everything independently. If the call is supposedly from your bank, hang up. Find your bank’s official phone number from your statement or their website and call them directly. Never use contact information provided by the person who called you.

Never share sensitive information. Legitimate organizations will never call you and ask for your full account numbers, passwords, or Social Security number.15 And they will never ask you to pay for anything with cash, gold, wire transfers, or gift cards.

Talk to someone you trust. Before you take any action, call me, a trusted family member, or a friend. Simply saying the situation out loud to someone else can often reveal how ridiculous it sounds. This is also a great reason to ensure you have a trusted contact listed on your financial accounts.

When the Threat Is at Your Front Door

If a situation ever escalates to the point where someone you don't know shows up at your home, your personal safety becomes the top priority.

Your front door is your fortress. Never let a stranger inside your home, period. You are not obligated to open your door to anyone. You can speak through the locked door or an intercom.

Demand official identification. Ask them to hold their ID up to a window or peephole. A legitimate agent or employee will expect this and will not pressure you. If you are still unsure, keep the door locked, find the official number for their agency, and call to verify their employment and purpose for visiting.

Refuse all on-the-spot transactions. Never, ever hand over cash, checks, gold, or personal documents to someone who appears at your door.17 There are no legitimate circumstances where a government or financial institution would operate this way.

Call for help immediately. If you feel threatened in any way, or if they refuse to leave, do not hesitate. Call 911 immediately. Your safety is paramount.

Report the incident. Once you are safe, report the event to your local police, your financial institution, and the Federal Trade Commission (FTC).

Key Red Flags to Remember

Legitimate government and financial institutions will NEVER:

Threaten you with arrest or demand immediate payment.

Promise you a prize or lottery winning in exchange for a fee.

Call, text, or email you unexpectedly and ask for personal or financial information.

Instruct you to withdraw cash or buy gold to "secure your account."

Send a courier to your home to pick up money or valuables.

The goal here isn't to make you fearful of every knock on the door. It’s to make you prepared. By understanding these tactics and having a clear plan, you can confidently recognize a scam, protect your assets, and ensure your personal safety. You’ve worked too hard to build your retirement security to let a criminal take it away—especially one standing on your welcome mat.