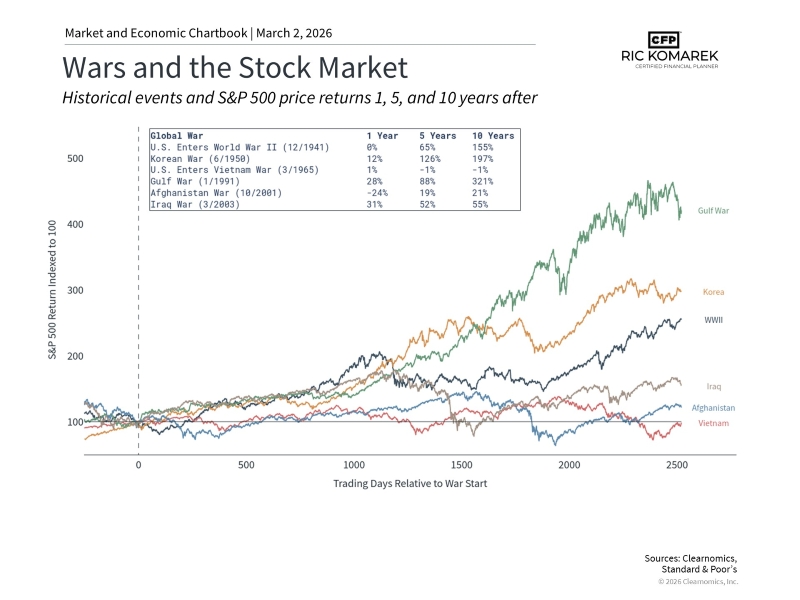

Navigating Geopolitical Storms: What the Latest Middle East Headlines Mean for Your Retirement

Published on: 02/03/2026

Worried about how recent strikes in the Middle East might impact your retirement nest egg? Let's look past the headlines and focus on the long-term fundamentals protecting your financial house

Investing