Medicare Explained: A Plain-English Guide for Retirees

As we plan for retirement, we (rightfully!) spend a lot of time focusing on our income plan, making sure we have enough money to live the life we want. But one of the single biggest pieces of your financial puzzle in retirement is healthcare. And the biggest part of healthcare for almost every retiree is, of course, Medicare.

I know it can seem incredibly complex, but it doesn't have to be. My goal today is to just break it down into simple, understandable terms.

Why is this so important? Well, for one, we're simply living longer than ever. When Medicare was first designed back in the 1960s, life expectancy was much shorter. Today, someone who is in their 60s can easily expect to live another 20 years or more. That longer, wonderful life also means more time to incur healthcare costs, which is why having a solid understanding of your Medicare benefits is absolutely essential to your financial security.

What is Medicare and Who Qualifies?

At its most basic level, Medicare is our country's health insurance program for folks who are 65 and older.

(There are some exceptions for those with permanent disabilities, but the 65-and-older rule applies to most retirees). For the most part, enrolling when you're eligible is mandatory.

You qualify for Medicare if you or your spouse worked for at least 10 years and paid Medicare taxes into the system. You've been paying into this fund your entire working life; now it's time to understand the benefits you've earned.

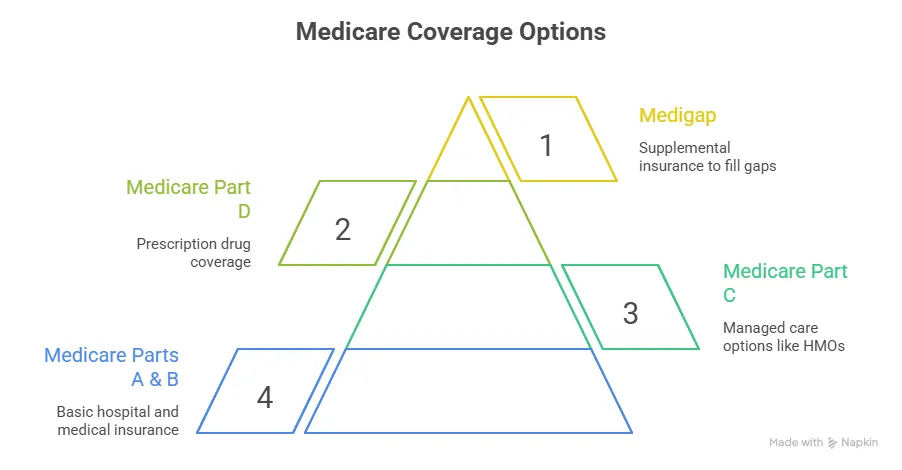

The Medicare Alphabet Soup: Parts A, B, C, and D

The most confusing part for most people is the "alphabet soup" of all the different parts. Let's clear it up.

Part A: Hospital Insurance

Think of Part A as your hospital coverage. It helps pay for things like:

A semi-private room during a hospital stay

Meals and nursing care in the hospital

Skilled nursing facility care (after a qualifying hospital stay)

Hospice care

Some home health services

Many people think of Part A as being "free" because most people don't pay a monthly premium for it (since you paid for it with your taxes). However, and this is a key point, it is not free. Part A has its own deductibles and co-pays that can be quite large, especially if you have a long hospital stay.

Part B: Medical Insurance

Part B is the other side of the coin. This is your medical coverage for services you receive outside of a hospital. This includes:

Doctor visits

Lab tests and surgeries

Ambulance services

Durable medical equipment

Preventative services

Unlike Part A, Part B does have a monthly premium that everyone pays. This premium can be higher based on your income (a system known as IRMAA).

Together, Parts A and B are known as "Original Medicare." Think of it as a solid 80/20 plan, where Medicare covers about 80% of your approved costs, and you're responsible for the other 20%.

Part C: Medicare Advantage

This is where things get really confusing, thanks to all the TV commercials. Part C, or "Medicare Advantage," is not a supplement to Original Medicare. It is a replacement for it.

These are private insurance plans, usually structured as HMOs, that bundle Parts A, B, and often D into one package.

Now, here’s my specific advice for our community: In our area—Redding and Shasta County—these plans are generally not a good option. We simply don't have the large network of doctors, hospitals, and services here to make these HMO-style plans work effectively. For that reason, you can essentially ignore the Part C-related mail you get. It’s not a practical choice for most of us here.

Part D: Prescription Drug Coverage

This one is easy to remember: D is for Drugs. This is the federal program that provides coverage for your prescription medications.

This is another part that requires a monthly premium. You must make a choice here. You have to pick a specific Part D plan from a private insurer. The "best" plan is different for everyone, because it depends entirely on the specific medications you take and the pharmacy you prefer to use.

This is why it's so important to review your Part D plan every single year during the Open Enrollment period (which runs from October 15th to December 7th). The plan that was best for you last year might not be the best one next year if your prescriptions change.

Don't Forget the "Gaps": What is Medigap?

So, if Original Medicare (A & B) is an 80/20 plan, what about that 20% you're responsible for?

Those are the "gaps"—the deductibles (like the big one for Part A) and the 20% co-pays for Part B. A single serious medical event could leave you with a very large bill.

This is where a Medicare Supplemental Policy, also known as "Medigap," comes in. This is a private insurance policy you purchase that works with Original Medicare to cover those gaps. It helps pay for your deductibles and co-pays.

A Medigap policy has its own monthly premium, but in my experience, it is definitely well worth considering for the peace of mind and financial protection it provides.

The Big Surprise: What Medicare Doesn't Cover

Many retirees are shocked to find out what's not covered by Original Medicare. Be prepared to pay for these services separately, as they are not included:

Dental care (exams, fillings, dentures, etc.)

Vision care (eye exams, glasses, contacts)

Hearing aids

Routine foot care

Long-Term Care (This is the big one. Medicare does not pay for custodial long-term care in a nursing home or assisted living facility.)

You must factor these major expenses into your retirement budget.

The Most Critical Step: When to Enroll (and How to Avoid Lifelong Penalties!)

This is the one thing you absolutely cannot get wrong. Missing your enrollment window can cost you dearly.

Initial Enrollment Period (IEP): This is your main window. It's a seven-month period that starts three months before the month you turn 65. If you sign up during those first three months, your coverage will start on the first of your 65th birthday month.

Special Enrollment Period (SEP): If you are 65 but still working for a large employer (20+ employees) and have "credible coverage" through that job, you're okay. You can (and probably should) delay enrolling in Part B to avoid paying the premium. Your SEP will give you a window to sign up without penalty when you eventually stop working.

The Penalty Trap: If you miss these windows and just sign up late (during the General Enrollment Period), you will face penalties. The Part B penalty is an extra 10% on your premium for every single year you were late... and that penalty is lifelong. It never goes away. This is a costly and completely avoidable mistake.

Your Medicare To-Do List

I know that's a lot of information, but it really boils down to this simple checklist:

Don't Be Late! Sign up for Part A and Part B during your Initial Enrollment Period (when you turn 65) or your Special Enrollment Period (when you retire from your job).

Mind the Gaps: Seriously consider a Medigap (Supplemental) policy to fill that 20% gap left by Original Medicare.

Pick Your Plan: Choose a Part D drug plan that matches your specific prescriptions.

Budget for the Rest: Remember to budget for dental, vision, hearing, and potential long-term care costs.

Medicare is the health foundation for your retirement. Taking the time to understand it now will save you a world of headaches—and a lot of money—down the road.