The Medicare Annual Check-Up: Why You Must Review Your Plan Before December 7th

Every fall, just as the leaves start to change, a critical window opens for everyone on Medicare. It’s the Medicare Open Enrollment Period, which runs from October 15th through December 7th.

I know, it’s tempting to just let your plan roll over. You're busy, and the mailers are overwhelming. If your plan worked this year, why wouldn't it work next year?

Here’s the danger in that thinking: The details of your plan—especially your prescription drug coverage—change every single year.

Think of your Medicare plan like the roof of your financial house. It's there to protect you from the high cost of healthcare. This Open Enrollment window is your one, non-negotiable, annual opportunity to get on the ladder and inspect that roof for any potential new leaks before the storm hits.

Failing to do this "annual check-up" is one of the easiest ways to get hit with a massive, unexpected financial surprise in January.

The Most Important Thing: Your Part D Drug Plan

If you do only one thing during this period, do this: Review your Part D Prescription Drug Plan.

Here’s why. Every insurance company that offers a Part D plan publishes a formulary. That’s just the fancy term for their specific list of prescription drugs that they agree to cover at favorable prices.

That formulary changes every single year.

A drug you’ve taken for years could be moved to a more expensive tier, or worse, dropped from the formulary altogether. I’ve seen this happen to clients: a medication that cost them a $40 co-pay in December suddenly costs them $400 in January, all because they didn't switch plans.

This is not a "maybe." This is a "guarantee." Your plan's costs and coverage list will be different in 2026. You should have received a document in the mail called the "Annual Notice of Change" (ANOC). This is your road map. It spells out exactly what's changing. Please, find it and read it.

Your Other Big Choice: Original Medicare vs. Medicare Advantage

This enrollment period is also your chance to decide how you want to receive your Medicare benefits. You can freely switch between these two main paths.

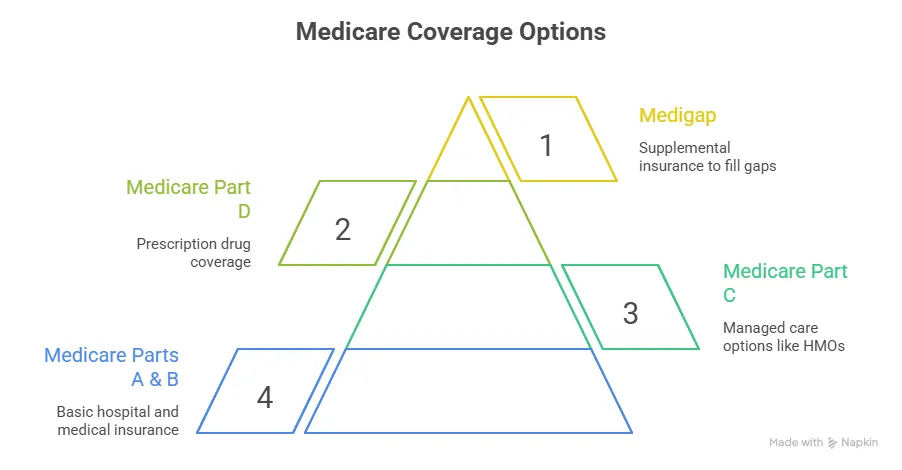

Original Medicare: This is the traditional, government-run program (Parts A and B). You can go to any doctor or hospital in the U.S. that accepts Medicare. Most people pair this with a Part D plan (for drugs) and a Medigap plan (to cover the 20% co-insurance and deductibles).

Medicare Advantage (Part C): These are private, all-in-one plans that bundle Parts A, B, and usually D into one package. They often have low (even $0) premiums and include extra benefits not covered by Original Medicare, like dental, vision, and hearing.

So, why would anyone not choose Medicare Advantage? The trade-off is networks.

Medicare Advantage plans work like an HMO or PPO. You have to use their network of doctors and hospitals. If you need to see a specialist, you may need a referral.

This is the second critical item to check: If you have a Medicare Advantage plan, you must log in to the plan’s website and confirm that your favorite doctors, specialists, and hospitals are still "in-network" for 2026. Just like the drug list, these networks change every year.

Your Quick-Hit Checklist Before December 7th

This doesn't have to be complicated. Here's your checklist:

Find your ANOC. Open that "Annual Notice of Change" letter.

Check your drugs. Make a list of all your prescriptions. Go to the Medicare Plan Finder website (Medicare.gov) and see which Part D plan will cover those drugs at the lowest total cost.

Check your doctors. If you have a Medicare Advantage plan, confirm all your important doctors and your preferred hospital are still in the network for 2026.

Review the "extras." If you're on Original Medicare, are you paying too much out-of-pocket for dental? It might be time to compare that cost against a Medicare Advantage plan that includes it.

You have until December 7th to make a new choice. Any changes you make will take effect on January 1st.

Don’t let yourself be surprised by a 500% increase in your medication costs next year. This is a key part of protecting the financial house you’ve worked so hard to build. Let's make sure your roof is secure for 2026.