The New Tax Bill: What It Means For Your Retirement

You've probably heard about the new tax and spending bill that was recently signed into law, often referred to as the "One Big Beautiful Bill." As your financial quarterback, I wanted to provide some clarity on what this bill means for you and your retirement plan. I understand that when these things hit the news, they can feel overwhelming, especially with all the political debates and complex details. My goal is to break it down simply and focus on what truly matters to you and your financial security.

So, let's look at the key provisions in the new law.

What’s in the New Tax Bill?

The new law, which the administration calls the "One Big Beautiful Bill," extends and expands many provisions from the 2017 Tax Cuts and Jobs Act (TCJA) that were set to expire. For people in or near retirement, here are a few things to pay close attention to:

Tax Rates and Deductions: The current tax rates and brackets set by the TCJA are now permanent, providing long-term certainty. The standard deduction also increases to $15,750 for single filers and $31,500 for married couples filing jointly. This can be a huge benefit for you.

A "Senior Bonus": Seniors get an additional $6,000 deduction (with income limits) through 2028, which is often referred to as the “senior bonus.”

State and Local Taxes (SALT): The cap on state and local tax deductions increases significantly from $10,000 to $40,000. This limit is set to grow by 1% annually through 2029, then return to $10,000 in 2030. This is an important detail for those of us who do live in a high-tax state like California.

Estate Tax Exemptions: Estate tax exemptions will remain high, increasing to $15 million for individuals and $30 million for couples in 2026. This means fewer families will be subject to federal estate taxes. However, it's still so important to have a comprehensive plan, because some states have their own estate taxes with much lower thresholds.

Why This Matters for Your Retirement Plan

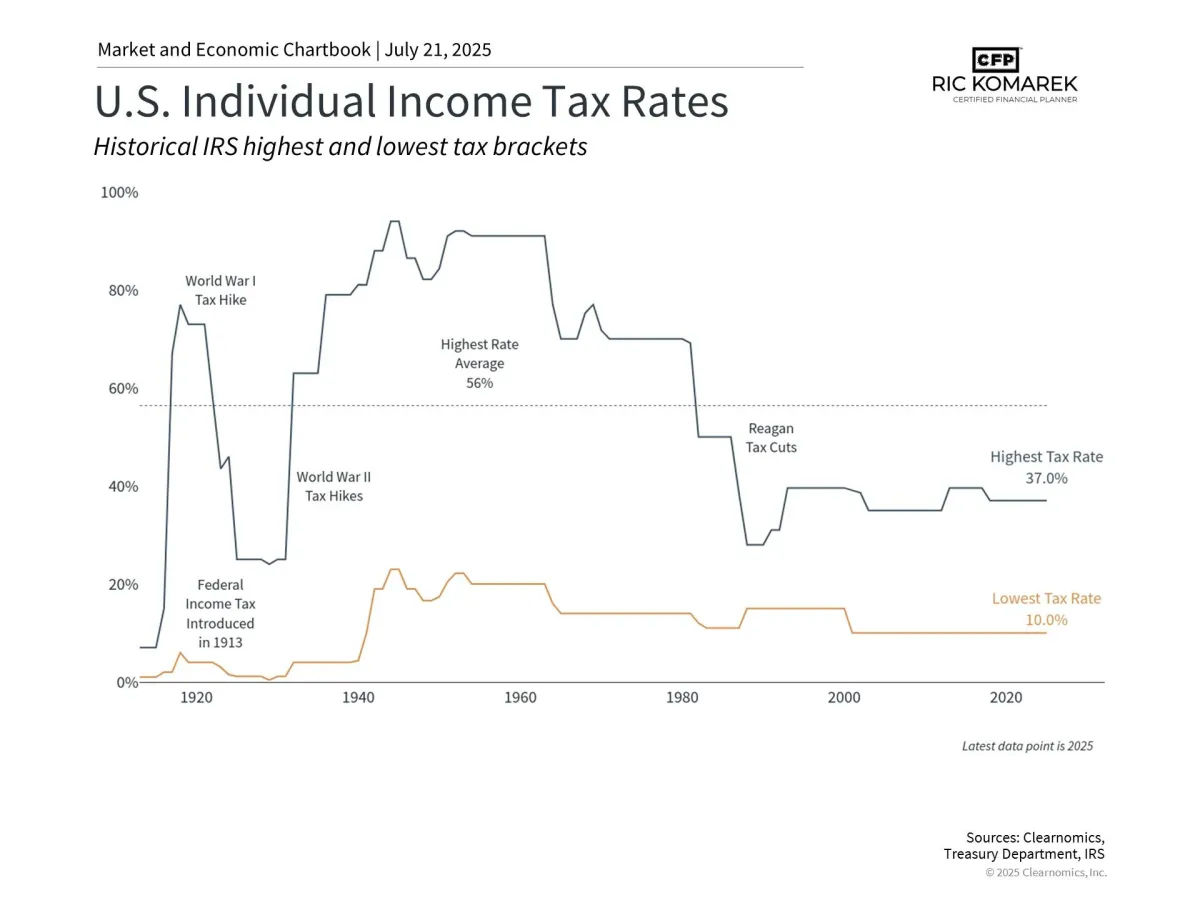

This legislation removes what many called the "tax cliff" - a situation where tax rates could have increased dramatically if the previous provisions had expired. By providing certainty, it allows us to make more confident long-term financial plans for you and your family. The bill maintains the relatively low tax environment we've experienced in recent decades. When you look at history, current tax rates remain well below the peaks of the 20th century, when top rates sometimes exceeded 90% during wartime periods.

The Bigger Picture: Government Spending and Debt

Now, I know you may be wondering about the bigger picture, especially with the news about government spending and the national debt. The Congressional Budget Office estimates this bill will add over $3 trillion to the national debt over the next decade. The federal debt already totals $36.2 trillion, or around $106,000 per American. This is a significant amount, and it’s a topic that has worried investors for years. However, history has shown us that the worst-case scenarios people fear often don’t materialize. While higher debt can influence things like interest rates and inflation over time, it’s not something that should derail your overall investment strategy.

This brings me back to the core principles of what we do together. The key to weathering these kinds of changes is maintaining a diversified portfolio that can perform well across different economic environments.

Moving Forward

While tax policy changes can affect your personal finances, they typically have a limited impact on your long-term investment opportunities. The market has historically grown regardless of tax policy changes, and the economy has shown resilience across different fiscal environments. The most important takeaway is that this bill extends the current low-tax environment and provides more certainty for planning.

So, what’s our next step? We'll continue monitoring how these changes develop and their impact on your financial plan. The most important thing you can do is to continue to trust in the solid, diversified plan we’ve built together. A well-constructed plan designed to weather various conditions remains the best approach for building and protecting your wealth over the long haul.

If you have questions about how these changes affect your unique situation, please don't hesitate to reach out.