Your Year-End Financial Inspection: 3 Moves to Consider Before December 31

As we head into the final stretch of 2025, it’s easy to get caught up in the holiday rush. But just like you wouldn’t ignore a leaky roof before winter sets in, we can't ignore the "structural" maintenance your financial house needs before the calendar turns.

While financial planning is something we do all year round, December 31 is a critical deadline for several tax-related strategies. This is our chance to look at the blueprints we’ve built together and make sure everything is sealed tight against unnecessary taxes.

Here are three specific areas we should look at before we ring in the New Year.

1. RMDs: The Mandatory "Maintenance" You Can’t Skip

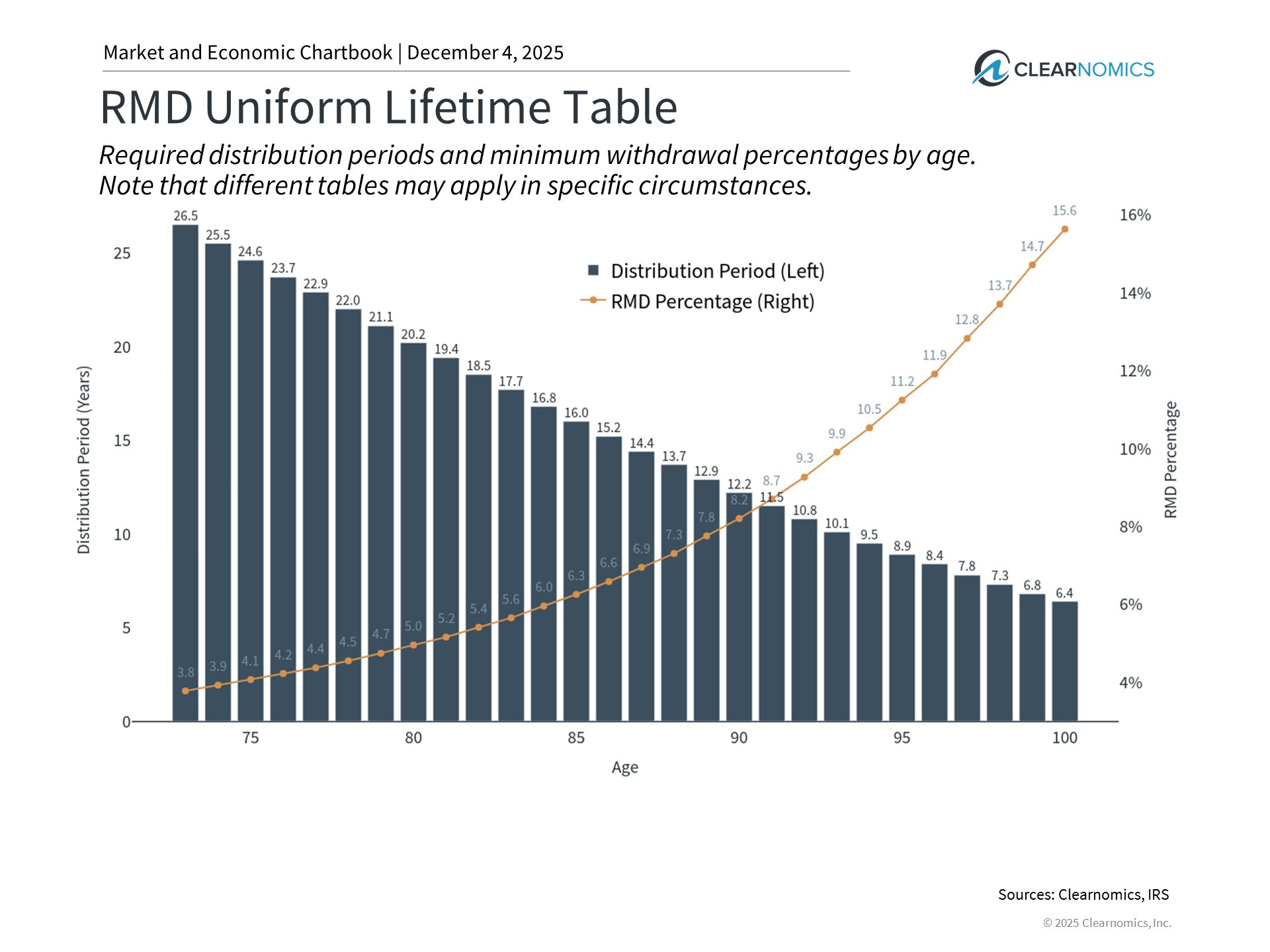

Think of Required Minimum Distributions (RMDs) as the government’s mandatory pressure relief valve. For years, you’ve built up pressure in your tax-deferred accounts (like traditional IRAs and 401(k)s) by saving pre-tax money. Once you reach a certain age, the IRS requires you to open that valve and let some of it out—and pay taxes on it.

With the SECURE 2.0 Act, the age for starting these distributions has risen to 73 for many of you. While it's great to have that extra time for your money to grow, missing the December 31 deadline can be costly. The penalty is currently 25% of the amount you were supposed to withdraw. That’s a steep fine we want to avoid!

A few things to keep in mind as we check this off the list:

The "First Year" Trap: If this is your very first year taking an RMD, you technically have until April 1 of next year to take it. But be careful—doing that means you’ll have to take two distributions in one tax year (the delayed one and the current one). That could spike your income enough to push you into a much higher tax bracket.

The Charitable Option: If you don't need the cash for living expenses, we can look at a Qualified Charitable Distribution (QCD). This allows you to send money directly from your IRA to a charity. It satisfies your RMD requirement, but because the money never touches your bank account, it doesn’t count as taxable income. It’s a win-win.

2. Roth Conversions: Renovating Your Tax Plan

If RMDs are mandatory maintenance, think of a Roth conversion as a strategic renovation. This is where we voluntarily move money from a Traditional IRA to a Roth IRA. Yes, you pay taxes on that money now, but in exchange, it grows tax-free forever, and you (and your heirs) won't have to worry about taxes on it later.

This year, we have some clarity thanks to the "One Big Beautiful Bill" passed by Congress, which has made the current lower tax rates permanent. This is great news because it removes the fear of rates snapping back up unexpectedly in the near future. However, even with stable rates, a conversion might still make sense if we expect your personal tax bracket to be higher in retirement—perhaps due to those RMDs we just talked about or Social Security kicking in.

Two quick warnings before we start swinging the hammer on this renovation:

The "Backdoor" Route: If your income is too high to contribute directly to a Roth, we can use a "backdoor" conversion strategy. It’s perfectly legal, but the paperwork needs to be precise.

The Medicare "Gotcha": converting a large amount of money adds to your reported income. If it goes too high, it can trigger something called IRMAA (Income-Related Monthly Adjustment Amount), which is a fancy way of saying your Medicare premiums will go up. We need to measure twice and cut once here.

3. Tax-Loss Harvesting: Pruning the Garden

Finally, let’s look at your taxable investment accounts (this doesn't apply to your IRAs). Nobody likes it when an investment loses value, but we can actually turn those "lemons" into lemonade for your tax bill.

This strategy is called tax-loss harvesting. It’s like pruning the dead branches off a rose bush to help the whole plant thrive. By selling an investment that has dropped in value, we "harvest" a loss. We can use that loss to offset other capital gains you’ve realized this year. If your losses are bigger than your gains, you can even use up to $3,000 of that loss to offset your ordinary income (like your wages or pension).

There is one major rule to watch out for: The "Wash Sale" rule. The IRS says you can’t sell a stock to claim a loss and then turn around and buy the "substantially identical" stock within 30 days. You have to wait, or buy something different that keeps you invested in the market without being identical.

Let’s Secure Your Foundation

The goal of these strategies isn't just to pay fewer taxes this year; it's to build a "moat" around your retirement nest egg that protects it for the long haul. Every dollar we save in taxes is a dollar that stays in your financial house, supporting your lifestyle and your legacy.