Gratitude and Growth: Putting Market Cycles in Perspective

As the holiday season begins, it’s the perfect time to pause and appreciate what we have, both in our personal lives and our financial lives.

It is human nature—and certainly common for investors—to focus on what could go wrong rather than what has gone right. We see a scary headline or a dip in the daily numbers, and our "fight or flight" instincts kick in. But with the markets performing well this year, I want to take a moment to reflect on the past year to gain some much-needed perspective as we look ahead to 2026.

When we look at the data, there are three big reasons to be thankful as an investor, and here is what they mean for your financial plan.

1. We Are Riding a Resilient Bull Market

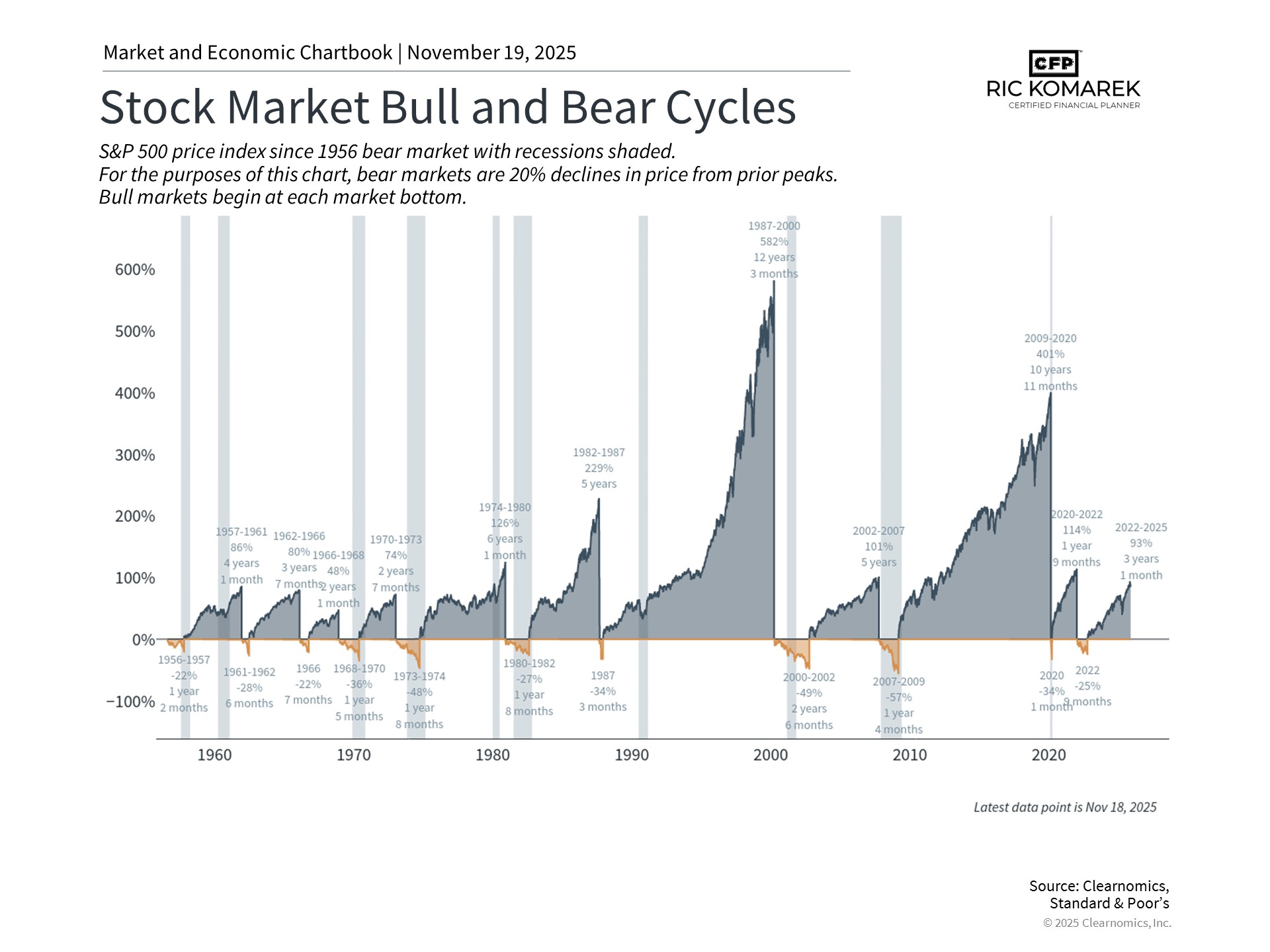

I want you to take a close look at the chart above. This shows the history of the S&P 500 (the 500 largest publicly traded companies in the U.S.) going back to 1956.

What do you see? You see massive, towering gray mountains representing "Bull Markets" (times of growth), and much narrower orange valleys representing "Bear Markets" (times of decline).

We can be grateful that we are currently in one of those gray zones. This current growth cycle began after the market bottomed out in October 2022, and we are now entering its fourth year. As the chart shows, this cycle has already seen returns of over 90%.

While past performance is never a guarantee of future results, history tells us a comforting story:

Bull markets tend to last much longer than bear markets (often five to ten years).

The "good times" tend to be significantly stronger than the downturns.

This resilience highlights why I always talk about the "long game." Remember the volatility we saw earlier this year? Markets dipped, and it felt uneasy. But those who stayed disciplined and didn't react to the fear were rewarded as the market rebounded to new highs.

2. The "Inflation Fever" is Breaking

Second, we can be thankful that the inflation picture has improved.

Now, I know what you might be thinking: "Ric, I still see high prices at the grocery store." You are absolutely right. Prices have risen about 3% over the past year, and that is still a pinch for our household budgets.

However, from an investment perspective, the fear of runaway inflation has faded. Because inflation is cooling off, the Federal Reserve (the "Fed") has been able to take its foot off the brake and start cutting interest rates.

Why does this matter for your retirement?

Lower rates help stocks by reducing borrowing costs for companies.

Lower rates help bonds by making the existing bonds you hold more valuable.

While we aren't out of the woods entirely, the worst fears regarding inflation seem to be in the rearview mirror.

3. Your "Financial House" is Built for This

Finally, we should appreciate the importance of not putting all our eggs in one basket.

The year ahead will likely bring new questions. In 2026, we will continue to hear debates about Artificial Intelligence and its impact on the economy—much like we did during the internet revolution of the 90s. We will undoubtedly see political volatility, discussions about tariffs, and geopolitical concerns.

If you didn't have a plan, these headlines might keep you up at night. But you do have a plan.

Think of your portfolio like a well-built house.

We have built a foundation to withstand the "orange valleys" of market drops.

We have built a structure to capture the growth of the "gray mountains" of bull markets.

We have a roof to protect against the rain of inflation.

Your portfolio is positioned to benefit from innovation and growth while managing the risks that inevitably come along.

Let's Connect

The holiday season is an ideal time to reflect on the many reasons to be thankful, but it's also a great time to review your "financial house."

If your goals have shifted, or if you just want to walk through the chart above and see how it applies to your specific retirement numbers, please don't hesitate to reach out. I’m here to help ensure your portfolio continues to give you the peace of mind you deserve.

Happy Holidays!